Automate Tax Reconciliation

4.8/5 stars for client support

Reconcile product movements, the general ledger, and tax return data before paying what you owe. Ensure your accounts are balanced and mitigate financial risk to the business with tax reconciliation software.

Leverage data reconciliation software built for tax

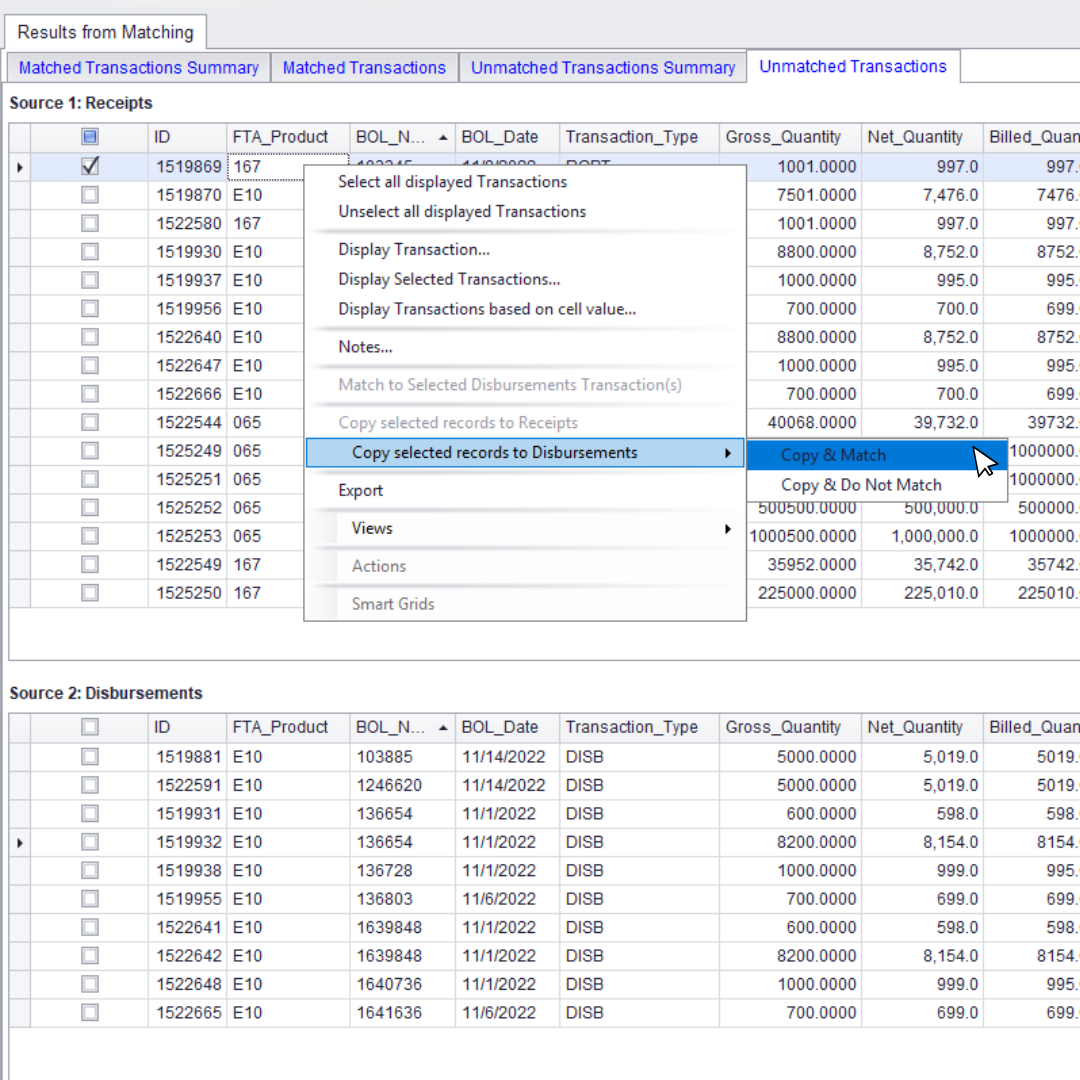

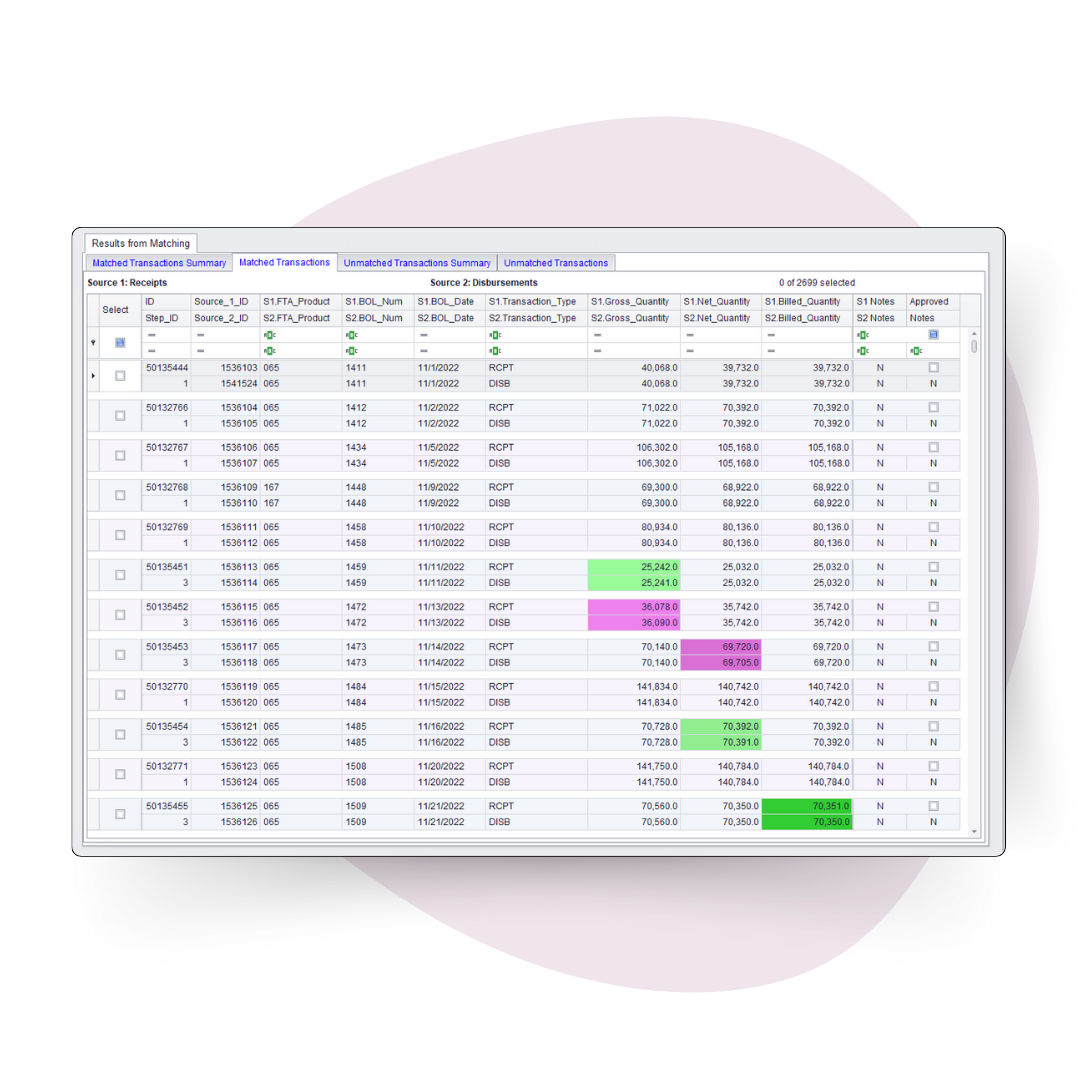

Our data reconciliation software allows you to reconcile against multiple data sets with configurable matching logic to find discrepancies before remitting payment.

Reconcile business data for tax compliance

Instead of reconciling after the filing period via spreadsheets which require redundant, manual data prep and are prone to human error.

Use ComplyIQ by IGEN to proactively reconcile and you could see up to a 92% increase in reconciliation efficiencies.

The teams behind tax reconciliation

It’s assisted, exception-based reconciliation for tax compliance

Streamline exception-based reconciliation for tax compliance with data reconciliation software built with tax teams in mind.

Reduce Risk of Audits & Penalties

Reduce Time Spent Preparing Data

Increase Tax Reconciliation Efficiencies

Leave manual reconciliation, prone to human error, behind. Say hello to assisted tax reconciliation in one transparent platform.

Connect to your existing systems

Back-office Systems

Our platform’s API architecture enables connection to your existing back-office system without significant modifications or custom-built middleware.

E-commerce Platforms

Pre-built integrations to common e-commerce for real-time tax calculations.

Transparent data matching

Robust Data Engine

Ensure your data is accurate, complete, and formatted correctly. Identify unexpected errors, correct those issues, and create automation to resolve similar problems next time.

Exception reporting

Identify Discrepancies

Resources

From the ComplyIQ Tax Team

How to Overcome General Ledger Reconciliation Challenges

Exception Reporting in Excise Tax

Automate Tax Reconciliation

Help your business do tax reconciliation right, with ComplyIQ by IGEN. Talk to an expert today.