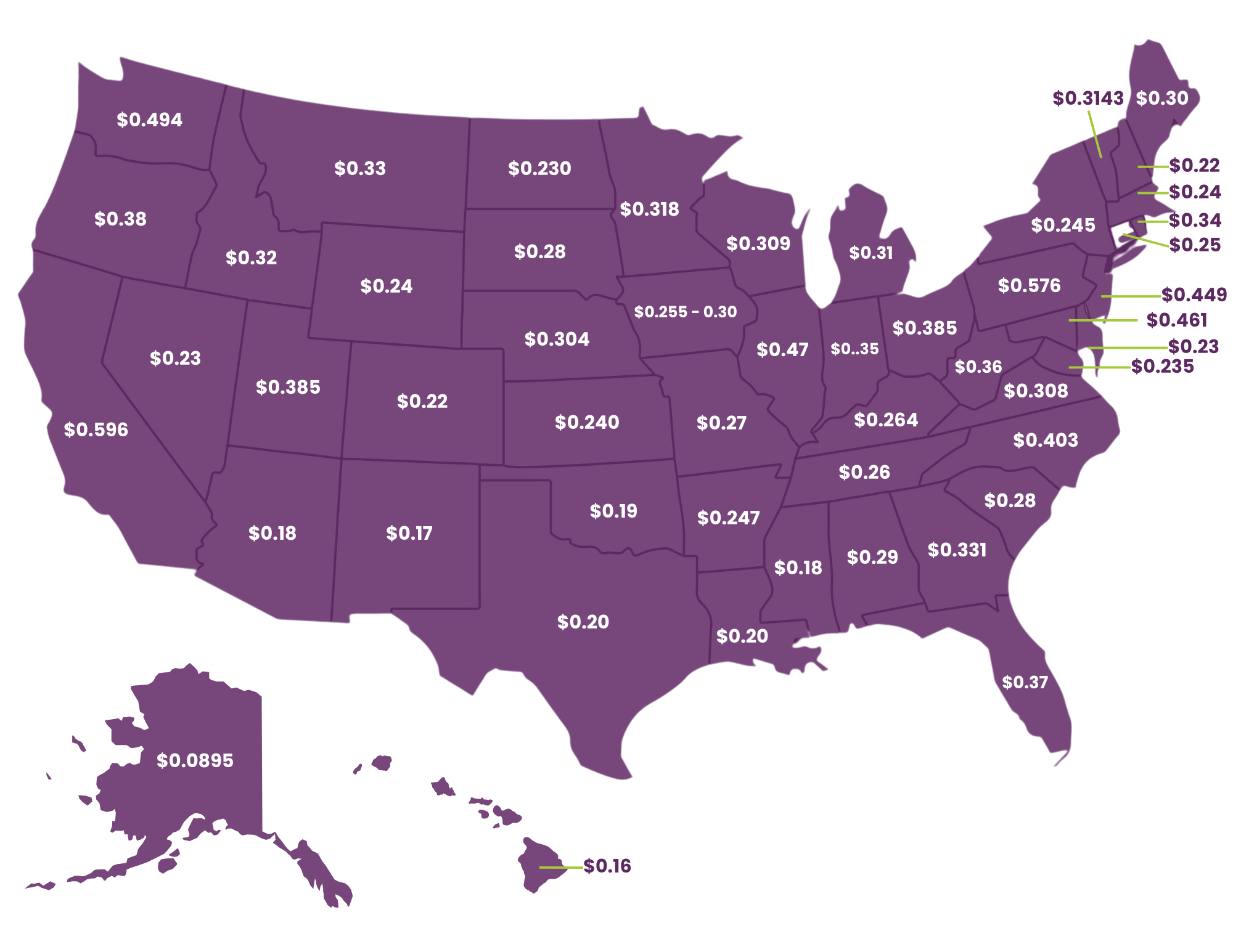

Gasoline State Excise Tax Rates for 2025

State Excise Tax & Federal Motor Fuel Tax Rates

See current gas tax by state. Check out the state excise tax rates for gasoline, see federal motor fuel tax rates, and which states have the highest and lowest excise tax rates.

Plus, download our 2025 State Excise Tax Rate Info Table to view diesel, aviation fuel, and jet fuel tax rates for this year.

Gas Tax by State [Excise]

| State | Gasoline Tax |

|---|---|

| Alabama | $0.29 / gallon |

| Alaska | $0.0895 / gallon |

| Arizona | $0.18 / gallon |

| Arkansas | $0.247 / gallon |

| California | $0.596 / gallon |

| Colorado | $0.22 / gallon |

| Connecticut | $0.25 / gallon |

| Delaware | $0.23 / gallon |

| District of Columbia | $0.235 / gallon |

| Florida | $0.37325 / gallon |

| Georgia | $0.331 / gallon |

| Hawaii | $0.16 / gallon |

| Idaho | $0.32 / gallon |

| Illinois | $0.47 / gallon |

| Indiana | $0.35 / gallon |

| Iowa | Between $0.255 – 0.30 / gallon |

| Kansas | $0.240 / gallon |

| Kentucky | $0.264 / gallon |

| Louisiana | $0.20 / gallon |

| Maine | $0.30 / gallon |

| Maryland | $0.461 / gallon |

| Massachusetts | $0.24 / gallon |

| Michigan | $0.31 / gallon |

| Minnesota | $0.318 / gallon |

| Mississippi | $0.18 / gallon |

| Missouri | $0.27 / gallon |

| Montana | $0.33 / gallon |

| Nebraska | $0.304 / gallon |

| Nevada | $0.23 / gallon |

| New Hampshire | $0.222 / gallon |

| New Jersey | $0.449 / gallon |

| New Mexico | $0.17 / gallon |

| New York | $0.2455 / gallon |

| North Carolina | $0.403 / gallon |

| North Dakota | $0.230 / gallon |

| Ohio | $0.385 / gallon |

| Oklahoma | $0.19 / gallon |

| Oregon | $0.38 / gallon |

| Pennsylvania | $0.576 / gallon |

| Rhode Island | $0.34 / gallon |

| South Carolina | $0.28 / gallon |

| South Dakota | $0.28 / gallon |

| Tennessee | $0.26 / gallon |

| Texas | $0.20 / gallon |

| Utah | $0.385 / gallon |

| Vermont | $0.3143 / gallon |

| Virginia | $0.308 / gallon |

| Washington | $0.494 / gallon |

| West Virginia | $0.357 / gallon |

| Wisconsin | $0.309 / gallon |

| Wyoming | $0.24 / gallon |

This analysis is intended solely for informational purposes and should not be considered tax advice or used for calculating fuel taxes.

Federal Motor Fuel Taxes

The current federal motor fuel tax rates are:

Gasoline tax: $0.184 / gallon

Diesel tax: $0.244 / gallon

Aviation fuel tax: $0.194 / gallon

Jet fuel tax: $0.219 / gallon*

*Most jet fuel that is used in commercial transportation is .044/gallon

What is Motor Fuel Tax Revenue Used For?

In 2019, revenues from the transportation fund were over $44 billion.

Depending on the jurisdiction, some of the revenue from gasoline and diesel taxes can only be used for transportation related programs like improving infrastructure. Other jurisdictions allow the revenues to be added to the general fund which is used for a variety of programs.

Meanwhile revenues from aviation fuel and jet fuel taxes mainly fund airport and Air Traffic Control operations by the Federal Aviation Administration (FAA).

Which State has the Highest Tax Rate?

The state with the highest tax rate on gasoline is California at $0.596 / gallon followed closely by Pennsylvania at $0.576 / gallon.

The highest tax rate on diesel is $0.741 / gallon from Pennsylvania.

Meanwhile, the highest tax rate on aviation fuel is Massachusetts at $0.335 / gallon.

Finally, DC has the highest tax rate on jet fuel at $0.235 / gallon.

Which State has the Lowest Tax Rate?

The state with the lowest tax rate on gasoline is Alaska at $0.0895 / gallon.

The lowest tax rate on diesel is $0.0895 / gallon also from Alaska.

Oklahoma claims the lowest tax rate on aviation fuel at $0.0008 / gallon. Oklahoma also enacts the lowest tax rate on jet fuel at the same rate of $0.0008 / gallon.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Bob Donnellan

Motor Fuel Tax Subject Matter Expert