Proactive Indirect Tax Risk Management Strategies

Effective indirect tax risk management is a necessity for a sustainable business strategy. With indirect taxes under increasing scrutiny, the stakes have never been higher. In fact, EY forecasts an alarming 79% increase in tax audits over the next two years. That means non-compliance or procedural missteps could result in penalties and operational inefficiencies.

Taking a proactive approach to indirect tax risk doesn’t just ensure compliance. It also strengthens your organization’s financial health, positioning it for long-term success and stability.

The Role of Tax within Enterprise Risk Management

A mistake many c-suite leaders make is discounting tax. Tax plays a crucial part in enterprise risk management, serving as both a risk and an opportunity within your organization. With increased eyes on tax from regulators and stakeholders, tax risks such as compliance failures and audit exposures could significantly impact financial stability and operations. Incorporating tax into your ERM is a wise move to identify, assess, and mitigate these risks, aligning them with organizational governance and long-term goals.

Actionable Strategies for Managing Indirect Tax Risk

An effective indirect tax risk management strategy goes beyond compliance. Here’s how tax leaders can align their risk management efforts with modern best practices:

Conduct Tax Audits and Risk Assessments

Does your tax team spend more time on manual tasks than strategic decision-Regular tax audits and risk assessments are essential for identifying compliance gaps, inefficiencies, and potential exposure to indirect tax penalties. A proactive approach helps uncover hidden risks, enabling your team to take corrective action before problems arise.

Take These Steps:

- Conduct a Comprehensive Risk Assessment: Evaluate indirect tax risks across multiple jurisdictions to stay ahead of changing regulations.

- Identify Inefficiencies and Bottlenecks: Review tax compliance, reporting, and transaction processes to pinpoint areas that could lead to errors or delays.

- Analyze Historical Audit Findings: Learn from past audits by reviewing findings and adjusting your internal controls and procedures to prevent future risks.

Take Action: Download the risk assessment checklist to get a pulse on your current tax risk management.

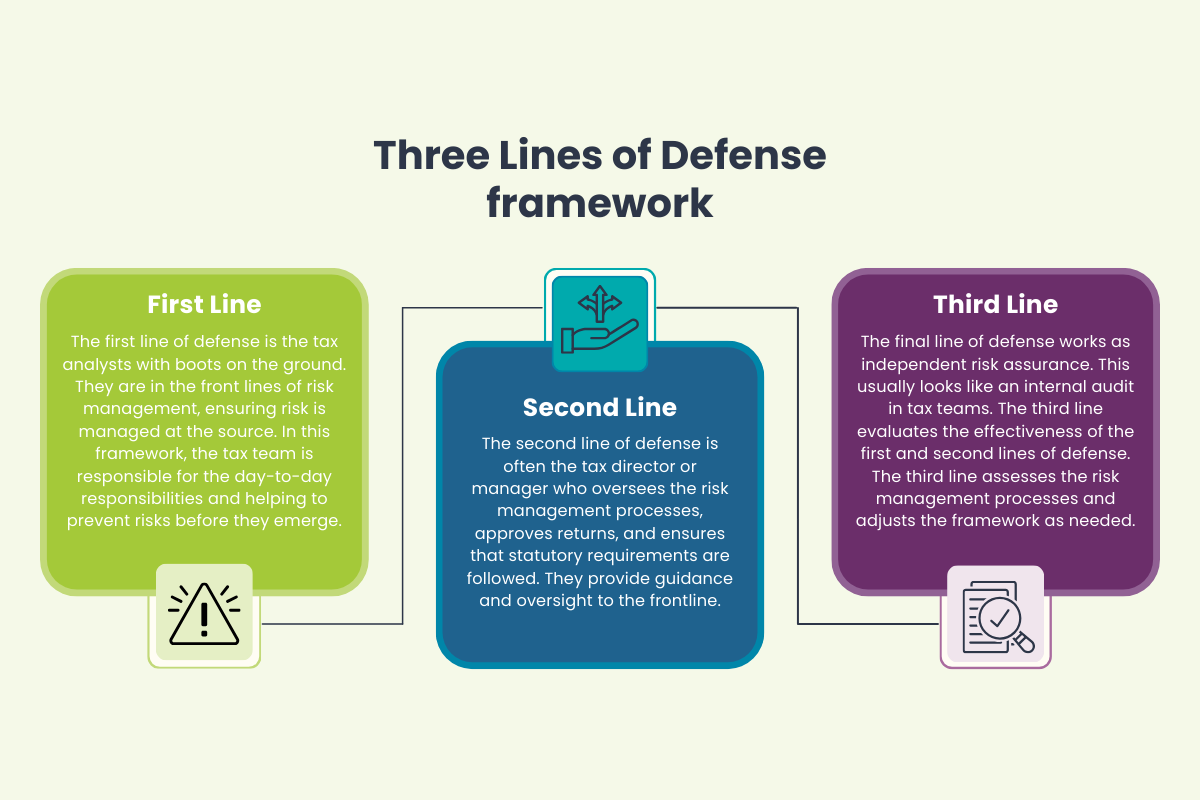

Leverage the Three Lines of Defense

Accountability is crucial, and using the Three Lines of Defense framework clarifies roles throughout the compliance lifecycle, reducing risk.

Structure it like this:

Key statistic to note:

According to research, 62% of businesses were found non-compliant during tax audits, highlighting gaps in the lines of defense.

Stay Proactive with Technology

Automation equips tax leaders with tools to minimize errors, enhance visibility, and maintain timely filings. By adopting advanced tax technologies, it becomes easier to streamline compliance processes.

What to focus on:

- Automate tedious filing and reconciliation processes to eliminate manual errors.

- Use real-time tracking software to monitor deadlines and team performance.

- Leverage analytics to uncover risk exposures and reduce liabilities.

- Verify licenses with license management software

Statistics supporting action:

- 74% of global businesses rate their indirect tax compliance as risky, according to this study.

- Digital transformation increased filing efficiencies by 80%, according to this case study.

Action Step: Research and invest in tax software tailored to your size, industry, and business model. Proactively advocate for these solutions by presenting potential cost savings and improved compliance outcomes. Download our Guide “Tax Technology Buyer’s Guide” for a step-by-step guide to making an informed decision when choosing tax technology.

Strengthen Cross-Department Communication

Indirect tax impacts multiple departments, including operations, finance, and legal. Collaboration and transparent communication are essential to ensure compliance and accomplish business goals.

Key approaches:

- Share tax updates across affected departments.

- Align on legislative changes that affect multiple teams.

- Implement platforms for shared visibility to streamline collaboration.

Action Step: Schedule routine communication touchpoints with your team and the organization’s leadership team during

regulatory updates, like law changes and new compliance regulations.

Identify and dismantle silos in your organization with the guide: Breaking Down Organizational Silos

Prepare for Audit Challenges

Audit preparedness is essential. Without proper documentation systems and internal checks, businesses risk penalties and prolonged scrutiny.

Strategies for preparation:

- Conduct mock audits to assess readiness.

- Centralize record-keeping for quick retrieval.

- Ensure a robust audit trail is maintained.

Relevant insight:

Action Step: Develop a centralized repository for all tax-related documents and implement a system for systematic updates to ensure you’re audit-ready.

Tax leaders are not just compliance enforcers; they are strategic partners shaping their organization’s financial resilience. By prioritizing indirect tax risk management and integrating advanced tools and structured processes, businesses can mitigate risks, safeguard their reputation, and maintain a competitive edge.

Empower Your Tax Team with Proactive Risk Management

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Bob Donnellan

Motor Fuel Tax Subject Matter Expert