Tax Job Descriptions for Hiring Managers & Job Seekers

In the world of taxation, a well-defined tax job description is more than a list of responsibilities; it’s a roadmap for success. For hiring managers, crafting a clear tax job description can make the difference in attracting top-notch candidates.

On the other hand, it provides job seekers with a deeper understanding of what is required, allowing them to tailor their approach to help land their perfect job. This post offers insights into creating and understanding tax job descriptions and resumes that stand out for both job seekers and hiring managers.

Understanding the hiring process

An effective hiring process is integral to finding the right tax professional and for a job seeker to find a company that matches their skillset. It starts with understanding the different structures of tax teams within companies of varying sizes. Small firms may seek versatile generalists, while larger organizations may require specialists. In this blog we are focused on small-to-mid-size companies. Hiring managers must navigate this landscape attentively to find the right match for their team’s unique needs.

Job seekers should use this to their advantage when curating their resumes for a specific position, but more on that later!

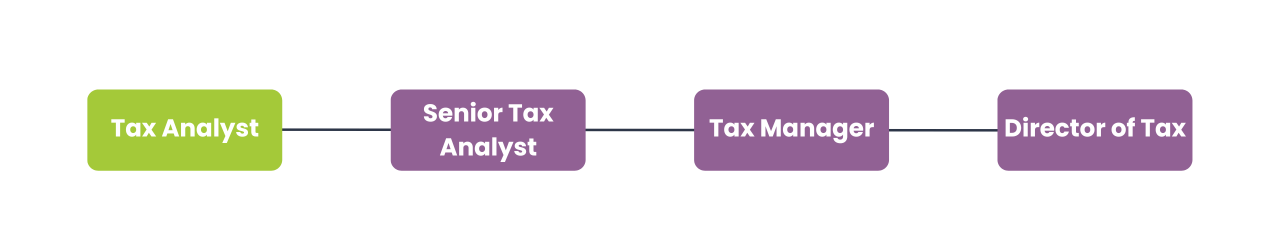

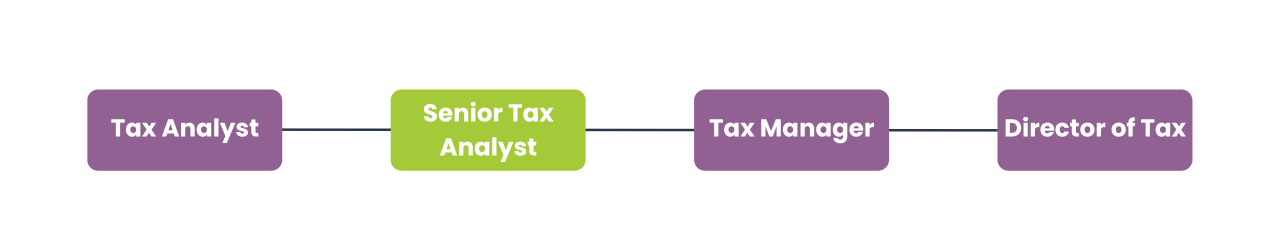

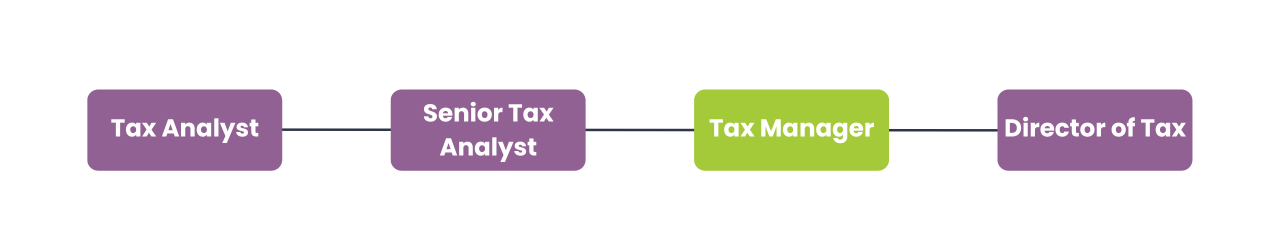

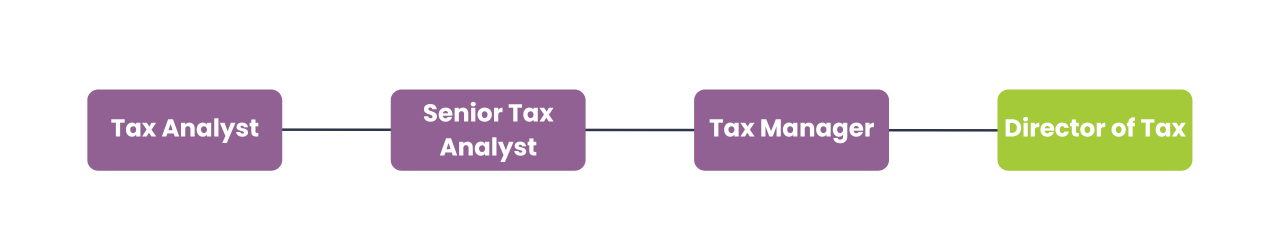

Tax department structure

As mentioned above, tax teams are built differently depending on the size of the organization. Tax is tricky because there isn’t much standardization in the field when it comes to job titles and tax team structures.

For example, a tax manager at one organization may have two direct reports and focus primarily on people management and strategy, whereas at a small company, the tax manager might do all the tax-related job duties with no direct reports.

Based on what we see most with our clients at small-to-midsize organizations, we highlighted relevant tax job descriptions and their accompanying peer positions with an idealized tax structure. Again, keep in mind that this can change based on the size and needs of the company.

Tax analyst

A job as a tax analyst is typically an entry-level foot in the door to the tax world. This role is responsible for assisting in preparing tax payments and returns and ensuring compliance with legal regulations.

Tax Analyst Job Qualifications

- Bachelor’s degree or Associate’s degree in accounting, finance, or similar field

- 1-4 years of work experience in tax

- Working knowledge of Excel

- Strong problem-solving and analytical skills

Tax Analyst Job Responsibilities

- Prepare tax returns for federal, state, and local jurisdictions

- Assist in ad-hoc analysis and tax projects

- Assist in general ledger allocation and tax adjustment analysis

- Reconcile tax accounts on a monthly and quarterly basis

- Correspondence with tax authorities regarding notices as needed

- Maintain filing records

- Stay current with tax legislation and compliance requirements

What Hiring Managers Are Looking for in a Tax Analyst

First and foremost, hiring managers are looking for a highly detail-oriented tax analyst. In tax, one error could cause penalties that impact the business’s bottom line so attention to detail is critical to being successful in this role. Organization is also important to maintaining a clear audit trail and staying ahead of filing deadlines. Finally, hiring managers are looking for tax analysts with a strong working knowledge of Excel. Most of the reconciliation and data preparation is done in spreadsheets at smaller-middle-sized companies.

Make sure as a job seeker, you are hitting on these qualities in your resume and your job interview.

Senior tax analyst

Analyzing and interpreting tax laws and regulations is the specialty of a senior tax analyst. Ensuring compliance and minimizing tax liabilities for companies or individuals is part of their role, along with researching and identifying tax issues, preparing tax returns, and providing guidance on tax strategies. Keeping up-to-date with changes in the field is crucial, as is advising the business.

Reviewing the work of junior staff, like an entry-level tax analyst, and providing training and mentorship may also fall within the responsibilities.

Senior Tax Analyst Job Qualifications

- Bachelor’s degree or Associate’s degree in accounting, finance, or similar field

- 3-5 years of work experience in tax accounting

- Proficient knowledge of Excel

- Strong technical and tax research skills

- Ability to work collaboratively with different functions of the business

Senior Tax Analyst Job Responsibilities

- Responsible for the preparation, payment and management of tax filings and payments

- Assist with audit and tax planning issues

- Perform analysis of property tax assessments and rates, as well as challenge assessments

- Provide input on improving tax processes

- Work collaboratively with different functions of the business

What Hiring Managers Are Looking for in a Senior Tax Analyst

Hiring managers are looking for an individual who is both a leader and proficient in tax preparation and filing. The perfect candidate would have high proficiency in Excel and proven work experience in maintaining an audit trail and keeping an error-free general ledger.

Like in the tax analyst position, this person should have immense attention to detail, be well organized, and have a desire to stay on top of the latest tax jurisdiction regulations to ensure compliance.

Make sure as a job seeker or hiring manager, the resume has keywords that are representative of desired soft skills and vocational skills.

Tax manager

Supervision over tax specialists, tax analysts, senior tax analysts, and senior tax specialists falls under the tax manager role, including help with the preparation of select tax returns and reviewing direct report tax returns.

A key responsibility for the tax manager lies in ensuring the accurate and timely filing and payment of returns. An understanding and ability to scrutinize complex transactions, reports, and activities thoroughly is crucial for the collection, remittance, and reporting of taxes and fees to the relevant authorities.

Tax Manager Job Qualifications

- Bachelor’s degree or Associate’s degree in accounting, finance, or similar field

- 5+ years of work experience in tax accounting

- 2+ years of supervisory experience

- CPA certification is preferred

- Experience in business development

- Strong technical expertise in tax planning, compliance, and consulting

- Exceptional leadership, communication, and interpersonal skills

Tax Manager Job Responsibilities

- Supervise the day-to-day activities of tax specialists or tax analysts

- Review all assigned tax returns for direct reports on a timely basis to ensure timely filing

- Develop staff members through technical training, which may include development of training material

- Stay updated on industry developments and tax law changes, including changes in tax rates

- Communicate with direct and indirect verticals of the company

- Maintain accurate and complete working papers supporting all Federal and State tax positions, including providing support for IRS and State audits

- Act as subject matter expert for relevant tax determination and compliance system

- Responsible for select areas of tax-related internal control

What Hiring Managers Are Looking for in a Tax Manager

When hiring managers are looking to hire a tax manager, they are looking for various soft skills, including great communication, interpersonal skills, attention to detail, deadline-oriented, and leadership qualities.

From a vocational side, hiring managers are looking for someone who has a strong proficiency with tax programs and software, has heavy experience in the nitty gritty of preparing and filing reports, experience with assessment and audits, and a keen understanding of tax regulations and laws.

Make sure as a job seeker or hiring manager, the resume has keywords that are representative of desired soft skills and vocational skills.

Director of tax

The director of tax is one of the highest leadership roles in the tax team structure. They are responsible for all company taxes, including income, sales & use, excise tax, and property taxes. They are also responsible for leading company efforts in the identification, implementation and support of tax planning strategies.

Director of Tax Job Qualifications

- Bachelor’s degree or Associate’s degree in accounting, finance, or similar field

- 10+ years of supervisory experience in tax

- CPA certification

- Experience in business development and tax provision

- Ability to explain and justify recommendations to all levels of the organization

- Ability to construct logical arguments to support tax positions

- Diplomacy, with the ability to work effectively with diverse people and different verticals of the business

Director of Tax Job Responsibilities

- Lead the process of identification and implementation of tax planning strategies by active involvement in the Company’s activities – e.g. recommend optimal structure of entities, tax reduction ideas, etc.

- Monitor tax and law changes and develop Company response to such changes, perform research on tax regulations and develop Company response

- Participate in special projects and related tax reduction opportunities

- Supervise tax staff in the preparation of tax returns and supporting information

- Support and own the internal control framework of the Company and Tax department

- Vigorously pursue automation to create efficiencies in tax return compliance

What Hiring Managers Are Looking for in a Director of Tax

Hiring managers are looking for an entrepreneurial and self-motivated individual with well-developed communication, influencing, and analytical skills.

The perfect candidate would have years of in-depth experience with tax research, business development, and delegating and managing an effective tax team.

Best practices for writing tax job descriptions

Well-crafted tax job descriptions are a beacon for the right candidates—those with the skills, experience, and cultural fit that will drive a company forward. Use the best practices below to create a game-changing job description.

Keep it Concise

Keep the tax job description and similar job sections simple and make sure it is optimized for skimming. Utilize headers and avoid industry specific jargon and complex phrasing. You can always talk details in the interview process.

Integrate Keywords

It’s key to include the right keywords in job ads. Why? Well, it helps snag the attention of the right tax folks who are job hunting. They’ll use certain words related to their skills and if those match your ad, bingo, they’ll see your job pop up.

Align with Company Values

Align your tone of voice and verbiage to reflect the company brand. Don’t forget to tie in the organization’s ethos and culture. This is something that should speak to the job seeker and help weed out applicants who don’t share common values.

Include Specific Industry Requirements

As you know from this blog and the industry overall, tax roles can vary greatly from company to company. Be sure to include any specific requirements or vocational knowledge necessary.

Best practices for creating a resume for a tax role

Crafting a standout resume is a crucial step for anyone looking to advance their career in the tax industry. Whether you’re a seasoned tax professional eyeing a promotion or a recent graduate eager to enter the field, a well-structured resume can set you apart from the competition. In this comprehensive guide, we’ll journey through the best practices for creating a resume tailored for tax job opportunities.

Highlight Relevant Education and Certifications

Your educational background is the foundation of your tax expertise. List your degree, any academic honors, and all relevant certifications and licenses, also emphasize specific job-related training and professional development in software, tax, accounting, and finance.

Showcase Relevant Experience

Experience is king when getting a job. At the end of the day, it doesn’t matter what your GPA was in school or your recent title if your job functions don’t align to the job description you are applying for. Practical experiences in the tax realm can significantly bolster your resume.

Include all relevant job duties, that reflect the job duties on the job you are applying for. Use the same keywords the hiring manager used. For example if they say “proficient experience with Excel”, use Excel instead of spreadsheets when highlighting your job experience.

Quantify Achievements and Results

Numbers speak louder than words, especially when it comes to speaking the language of another number-driven person, the hiring manager. Use statistics and metrics to illustrate the impact of your work and projects, like how much time or money you saved the team through specific tax strategies. Also, quantify your experience by listing how many tax returns you were in charge of filing, how many jurisdictions you filed in, and other volume metrics.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Nick Milledge

VP, Product Marketing