What is IRS Form 720?

At its core, IRS Form 720 is a Quarterly Federal Excise Tax Return.

It’s a reporting mechanism for businesses paying excise taxes on specific goods and services, like gasoline, tires, and indoor tanning services. The form is divided into three parts and includes several schedules that cover different types of excise taxes.

What Is the Purpose of Form 720?

Form 720, the Quarterly Federal Excise Tax Return, is primarily focused beyond revenue collection and serves as a regulatory tool. By imposing taxes on certain goods and services, the government can influence consumption patterns, particularly when these items pose risks to public health or the environment.

An early example of excise taxation in the U.S. was the tax on whiskey production in 1791, which, despite its initial unpopularity and eventual repeal in 1802, set a precedent for using taxation to address economic needs. Excise taxes have historically been crucial during financial strain, such as the Great Depression in 1934 when they constituted nearly half of federal revenues.

Today, federal excise taxes are levied on motor fuel, tobacco, alcohol, and other regulated goods and services, with states imposing additional excise taxes. These taxes often function as Pigouvian or sin taxes, pricing in the externalities or unintended consequences of consumption—like reducing cigarette use or curbing environmental pollution. They can also act as user fees, exemplified by the motor fuel tax, which indirectly charges drivers for road usage and related infrastructure wear.

Key Components of Form 720

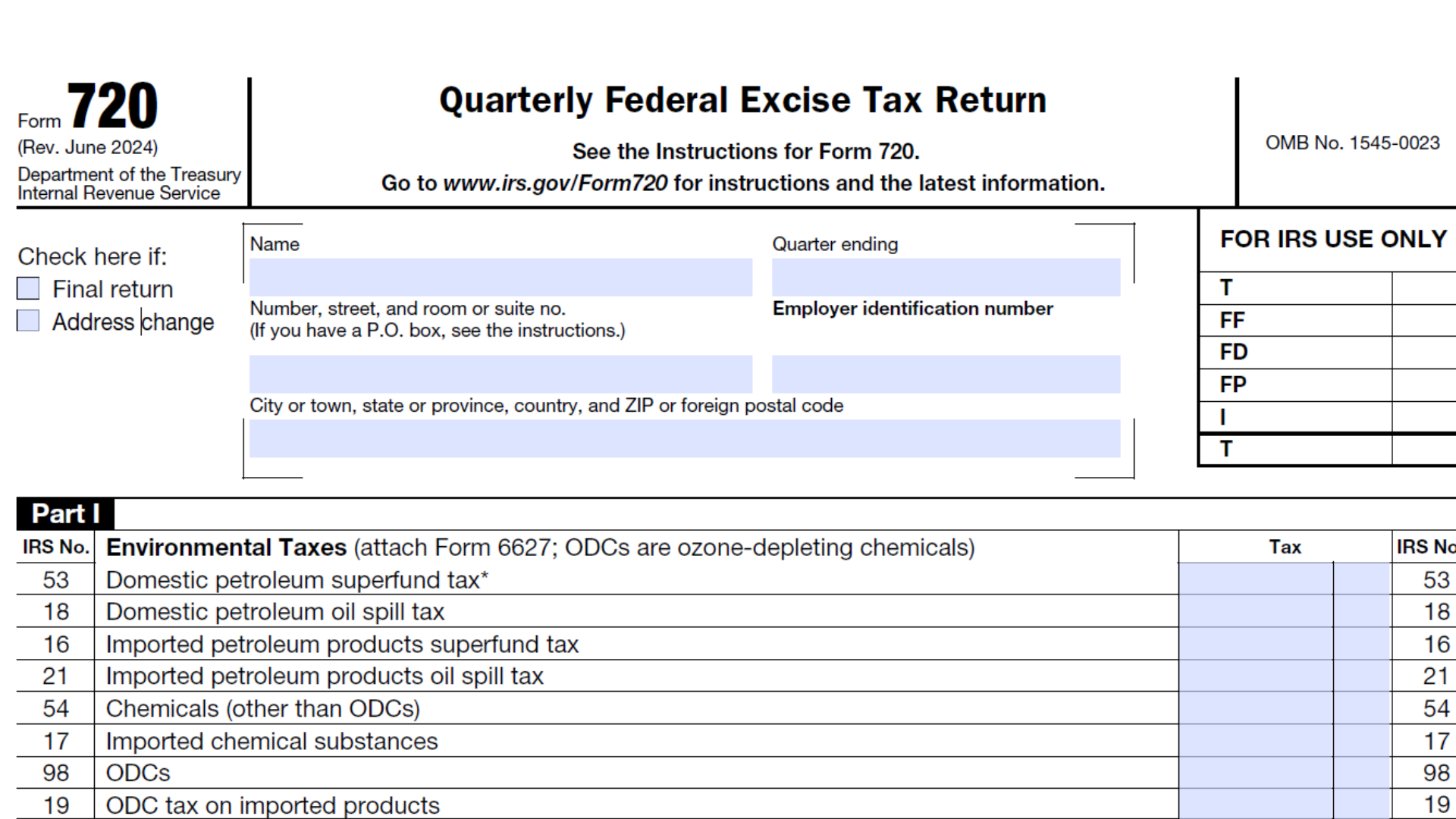

Part I

Part I of Form 720 covers areas of the business where companies need to pay excise taxes for products and services like:

- Environmental Taxes: petroleum oil spills, imported petroleum products, ozone-depleting chemicals, imported chemical substances.

- Communication and Air Transportation Taxes: telephone services, teletypewriter exchange services, transportation by air, and use of international airports.

- Fuel Taxes: diesel, dyed-diesel, kerosene, gasoline, aviation gasoline, liquified petroleum gas (LPG), compressed natural gas (CNG), liquified nitrogen, liquid fuel derived from coal, biomass, and natural gas.

- Retail Taxes: trucks, trailers, semitrailers, chassis and bodies, and tractors.

- Ship Passenger Tax: transportation by water.

- Foreign insurance Taxes: policies issued by foreign insurers like life insurance, casualty insurance, indemnity bonds, and annuity contracts.

- Manufacture Taxes: coal, tires, gas guzzlers, and vaccines.

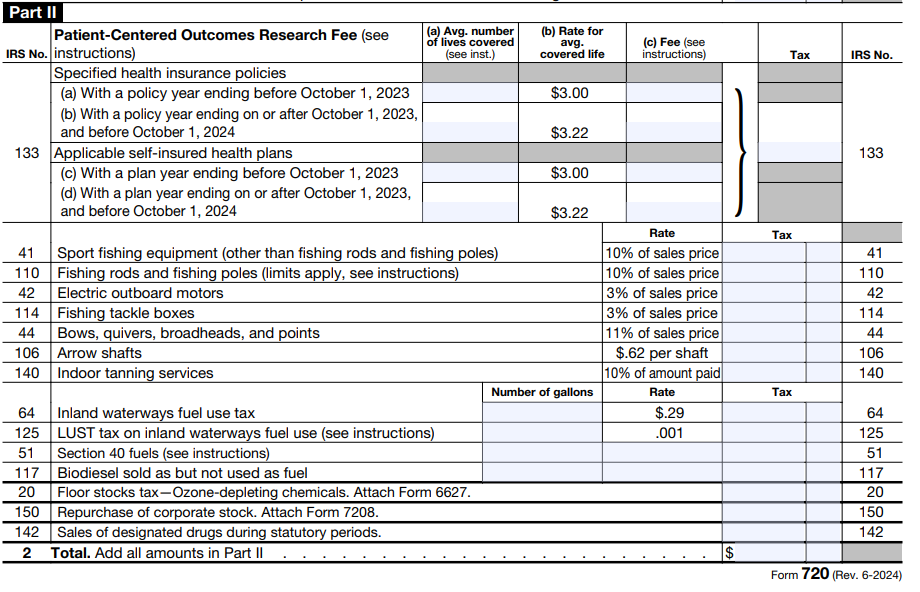

Part II

Part II of Form 720 covers businesses that provide the following products or services:

- Specified Health Insurance Policies

- Sport Fishing Equipment: poles, rods, tackle boxes, and outboard motors.

- Archery: bows, quivers, broadheads, points, and arrow shafts.

- Indoor Tanning Services

- Inland Waterways Fuel Use

- Biodiesel: sold as fuel but not used as fuel.

- Floor Stock and Repurchase of Corporate Stock

- Sales of Designated Drugs

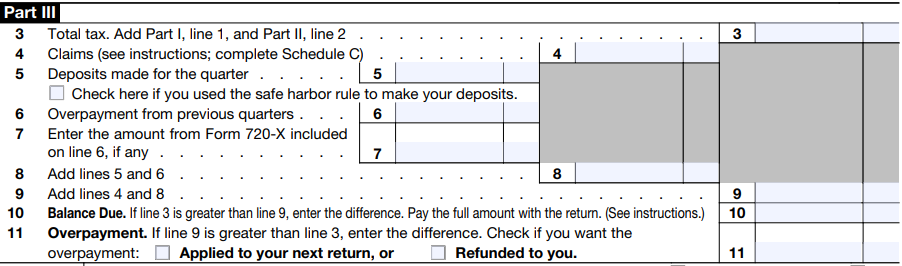

Part III

Part III of Form 720 is used for adjustments and credits related to the taxes reported in Parts I and II and previous overpayments.

Additional Schedules of Form 720

- Schedule A (Excise Tax Liability): helps calculate the total excise tax liability.

- You must complete Schedule A if you have a liability for any tax in Part I of Form 720. Don’t complete Schedule A for Part II taxes or for a one-time filing of the gas guzzler tax.

- Schedule T (Two-Party Exchange Information): pertains to the taxation of fuel transactions between parties.

- Schedule C (Claims): claims refunds for overpaid or incorrectly paid excise taxes.

- Complete Schedule C for claims only if you are reporting a tax liability in Part I or II of Form 720.

Who files Form 720?

Businesses required to file IRS Form 720 include those that pay excise taxes on certain goods and services, like fuel types, tanning bed services, and air transportation services.

The IRS states explicitly that you should file Form 720 if:

- You were liable for, or responsible for, any of the federal excise taxes listed on Form 720, Parts I and II, for a prior quarter, and you haven’t filed a final return.

- You are liable for, or responsible for collecting any of the federal excise taxes listed on Form 720, Parts I and II, for the current quarter.

When to File Form 720?

Timely filing is essential for all taxes, including Form 720. You must submit a return for each calendar year quarter according to the schedule below:

| Quarter Covered | Due By |

|---|---|

| January, February, and March | April 30 |

| April, May, and June | July 31 |

| July, August, and September | October 31 |

| October, November, and December | January 31 |

If a due date falls on a Saturday, Sunday, or legal holiday, you can file the return on the next business day.

How to File Form 720?

When filing Form 720, there are two main methods for submitting it before the specified due date: mailing it directly to the IRS or filing electronically through the IRS e-file program.

Mailing Form 720

Many businesses still opt to file Form 720 manually via mail. If that is the case for you, you can mail your form to the address:

Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0009

You must pay the balance due, indicated in box 10 of Part III, along with the form. Payment can be made via direct debit, check, or money order. Complete Form 720-V, the payment voucher form, and accompany your check or money order. Attach this voucher to your completed Form 720 and send both to the IRS. Remember always to keep a hard copy for your recordkeeping.

E-Filing Form 720

The faster and easier way to file Form 720 is by electronic filing using the IRS 720 Modernized E-File Provider program. This is a list of verified companies, like IGEN, who have passed the IRS Assurance Testing System (ATS) requirements for Software Developers of electronic IRS Excise Tax Form 720. This allows filers to get instant receipts and faster service than through the postal service.

For 720 E-filing, payment must be made by direct debit. Always make copies of your completed form for your records.

Best Practices for Form 720

Implementing best practices can streamline your reporting process, ensure compliance, and minimize the risk of costly errors. Below, we explore some tips and strategies to help you effectively manage your Form 720 filings, from accurate record-keeping to timely submissions.

Use a Due Date Tracking Software

Ensure you are filing on time, every single time, with a sophisticated tax calendar that has escalating alerts for important due dates!

Prioritize Record-Keeping for Tax Data

Maintain accurate and comprehensive records of all transactions subject to excise taxes. This includes detailed logs of quantities and types of goods or services subject to tax, invoices, receipts, and any other relevant documentation. Keeping organized records will help ensure accurate reporting on Form 720 and provide necessary backup in case of an audit or review.

File Electronically

Filing Form 720 electronically offers several advantages, including faster processing times and immediate confirmation of receipt by the IRS. Electronic filing also reduces the risk of errors through built-in accuracy checks and minimizes the paperwork involved in physical submissions. Additionally, it provides a secure and convenient way to manage tax filings, allowing businesses to track their submissions and payments online easily.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Bob Donnellan

Motor Fuel Tax Subject Matter Expert